Small Business Accounting Service In Vancouver Fundamentals Explained

Wiki Article

What Does Vancouver Accounting Firm Do?

Table of ContentsOutsourced Cfo Services for DummiesHow Small Business Accountant Vancouver can Save You Time, Stress, and Money.The Outsourced Cfo Services PDFs10 Easy Facts About Cfo Company Vancouver DescribedSome Of Small Business Accounting Service In VancouverTax Accountant In Vancouver, Bc - The Facts

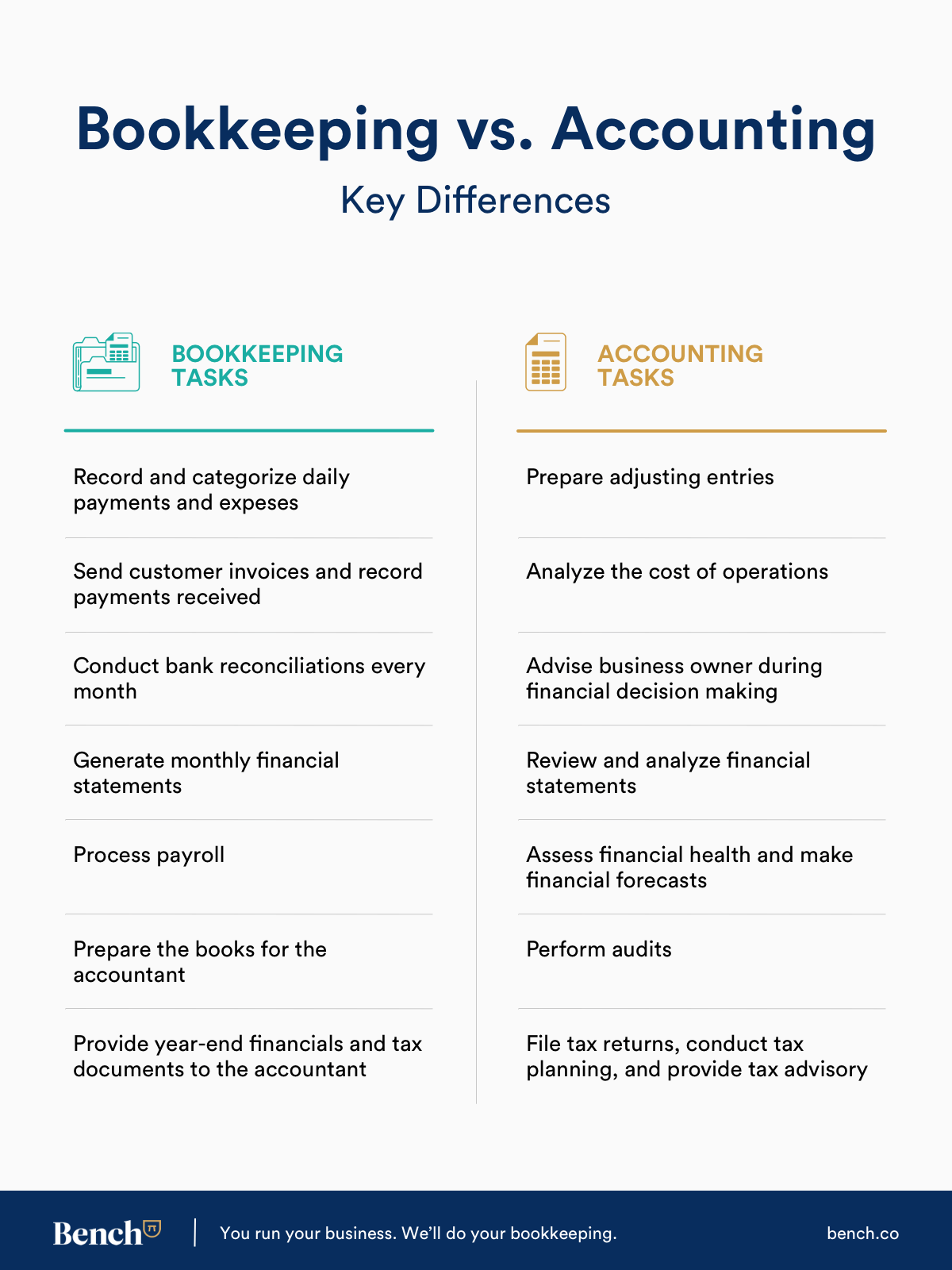

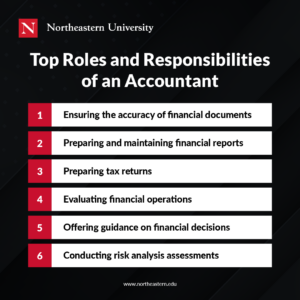

Below are some advantages to working with an accounting professional over an accountant: An accountant can offer you a thorough sight of your business's monetary state, along with approaches as well as referrals for making monetary choices. On the other hand, accountants are just in charge of recording economic transactions. Accounting professionals are required to complete more schooling, accreditations as well as work experience than bookkeepers.

It can be difficult to evaluate the suitable time to work with an accounting expert or accountant or to determine if you need one in all. While several local business employ an accounting professional as a specialist, you have a number of alternatives for taking care of monetary tasks. As an example, some small company owners do their own accounting on software their accounting professional recommends or makes use of, providing it to the accountant on a regular, month-to-month or quarterly basis for action.

It may take some background study to locate an ideal accountant since, unlike accounting professionals, they are not required to hold a professional qualification. A strong endorsement from a trusted colleague or years of experience are vital factors when employing an accountant.

Indicators on Tax Consultant Vancouver You Need To Know

For little companies, skilled money monitoring is a critical facet of survival and also development, so it's sensible to function with a monetary expert from the beginning. If you prefer to go it alone, consider starting with accounting software program and maintaining your publications diligently up to date. By doing this, ought to you need to employ a professional down the line, they will certainly have presence into the total financial history of your organization.

Some source meetings were carried out for a previous variation of this write-up.

Pivot Advantage Accounting And Advisory Inc. In Vancouver - Questions

When it pertains to the ins as well as outs of taxes, accountancy as well as financing, however, it never harms to have a seasoned expert to count on for assistance. A growing number of accountants are additionally taking care of things such as money flow forecasts, invoicing as well as HR. Inevitably, much of them are taking on CFO-like duties.For example, when it came to getting Covid-19-related governmental financing, our 2020 State of Local Business Research Study discovered that 73% of little business owners with an accounting professional claimed their accountant's suggestions was essential in the application process. Accountants can also aid company owner stay clear of expensive blunders. A Clutch study of small company proprietors programs that greater than one-third of small companies checklist unforeseen expenses as their top monetary difficulty, followed by the blending of service and also personal financial resources as well as the lack of ability to receive payments on schedule. Small company owners can anticipate their accounting professionals to assist with: Choosing the service framework that's right for you is essential. It affects just how much you pay in taxes, the documentation you need to file as well as your personal responsibility. If you're aiming to convert to a various company framework, it could cause tax consequences and also other difficulties.

Even business that are the same dimension as well as sector pay extremely various amounts for accounting. Prior to we enter into dollar numbers, let's speak concerning the expenses that enter into local you could check here business accounting. Overhead costs are expenses that do not straight develop into an earnings. Though these prices do not exchange money, they are required for running your organization.

Some Known Incorrect Statements About Small Business Accountant Vancouver

The average expense of accounting solutions for little organization differs for each unique circumstance. The ordinary month-to-month accounting fees for a little service will increase as you add extra solutions and also the get more tasks get more challenging.You can record deals as well as process payroll using on-line software application. Software application solutions come in all shapes and sizes.

The Only Guide to Tax Consultant Vancouver

If you're a brand-new business proprietor, do not forget to factor bookkeeping expenses right into your budget plan. Management costs and also accounting professional charges aren't the only accounting expenses.Your capacity to lead staff members, offer consumers, and also make decisions could experience. Your time is likewise beneficial as well as should navigate to this site be taken into consideration when checking out accountancy expenses. The moment invested in bookkeeping tasks does not create profit. The much less time you invest in bookkeeping and also taxes, the more time you need to expand your company.

This is not planned as lawful guidance; for additional information, please visit this site..

Vancouver Accounting Firm Can Be Fun For Everyone

Report this wiki page